Similar stories

Here’s some other articles that you may find interesting

Refinancing doesn't have to be difficult.

Sign up for free personalized refinance tracking

6 Min Read • 08/25/2023

Whether you’re in the process of buying a house or have already made the leap, it’s important to understand the ins and outs of Private Mortgage Insurance (PMI) and how it affects your financial journey. This article will break down PMI in simpler terms, explore its significance, delve into cost considerations, explain the calculation process, and offer strategies for shedding its burden.

Imagine you’re gearing up to buy a home, but the standard 20% down payment is a stretch. This is where PMI enters the scene. Picture it as a safety net for lenders. They want reassurance that if you struggle with payments, they won’t be left hanging. Since this involves higher risk, they tack on a monthly fee known as Private Mortgage Insurance.

Here are the things which you need to be aware of:

Needed for Low Down Payments: If your down payment is less than 20% of the house price, lenders usually require Private Mortgage Insurance (PMI).

Why It Matters: Lenders worry that without that 20%, you might have trouble keeping up with loan payments. PMI is their way of protecting themselves in case the loan goes south.

PMI is designed to protect the lender, not you. If you fall behind on payments, you home could still be taken away. Remember, you don’t get to decide if you want PMI; lenders decide based on your down payment.

The cost of PMI isn’t set in stone; it’s like a sliding scale. It usually falls somewhere between 0.5% and 2.2% of your total mortgage loan amount. Your actual payment depends on factors like your loan size and credit score.

Let’s use a simple example to demystify PMI:

Imagine you’re eyeing a $350,000 house, but you can only manage a $52,500 down payment (that’s 15% of the price). The lender says your PMI rate is 0.55%. Let’s crunch the numbers:

Your Down Payment: 15% of $350,000 = $52,500

The Loan Amount: House Price — Down Payment = $350,000 — $52,500 = $297,500

Yearly PMI: Loan Amount * PMI Rate = $297,500 * 0.55% = $1636.25

Monthly PMI: $1636.25 / 12 = $136.35

PMI comes into play when your down payment is less than 20% of the total value of the property. So, you’ll be able to stop paying PMI when that is no longer the case. This can happen in a few ways:

Knocking Down the Loan: Once you’ve paid off enough of the mortgage, usually around 78% of the original home value, you can bid farewell to PMI. For example, let us assume that the value of the property is $100,000 and you make a down payment of $15,000. As you start making your monthly payments, the $85,000 principal will be reduced to $80,000 or less. Now you have more than 20% equity in the house, and you can request your lender to stop the PMI payments.

Home Value Bump: PMI can also be removed when the appraised value of the house increases. In a hot real estate market, your home equity could reach 20 percent ahead of the loan payment schedule. In this case, it might be worth paying for a new appraisal. If you’ve owned the home for at least five years, and your loan balance is no more than 80 percent of the new valuation, you can ask for PMI. Let‘s assume that the property is worth $100,000. You make a down payment of $15,000 and your mortgage will be $85,000. Let’s say the appraised value increases to $110,000. Then the loan amount (ignoring the monthly principal paid) will be less than 77%. Again, you can request the lender to remove the PMI based on the new appraisal.

Halfway Through the Loan: With a 30 year-year mortgage, PMI often bows out at the 15-year mark, even if you still owe more than 80%.

Refinance: When conditions are favorable, refinancing with your current lender or a new one can lead to a better deal.

Get a New Home Appraisal: If your house’s value has surged, consider getting it appraised again. A higher value might erase or reduce your PMI.

Chip Away at Your Loan: Keep up with your monthly payments. Once your mortgage balance reaches 78–80% of your home’s value, you can typically wave goodbye to PMI.

Ask for Early PMI Cancellation: If you’ve made extra payments and brought your mortgage balance down to 80% of the home’s original value, you can often request an early PMI cancellation.

Experts suggest having some extra money for emergencies is a smart move. Before you dip into your savings or retirement funds to hit that 20% equity mark, chat with a financial advisor. If you locked in a favorable interest rate recently, it might not be wise to pull funds from investments to pay off a low-cost mortgage.

Let’s break down PMI with some real-world examples:

House Cost: $360,000

Down Payment: $72,000 (20%)

Loan Amount: $288,000

PMI: $0

Interest Rate: 6.25%

Loan Period: 30 years

Monthly Payment: $1773.27

Total Interest: $350,375.59

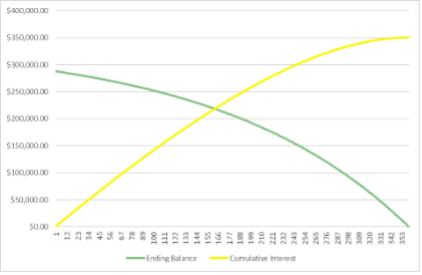

Balance and interest over time for a 30-year mortgage with 20% down payment and no PMI

House Cost: $360,000

Down Payment: $36,000 (10%)

Loan Amount: $324,000

PMI: $148.50

Total PMI: $13,513.50

Interest Rate: 6.25%

Loan Period: 30 years

Monthly Payment: $1773.27

Total Interest: $350,375.59

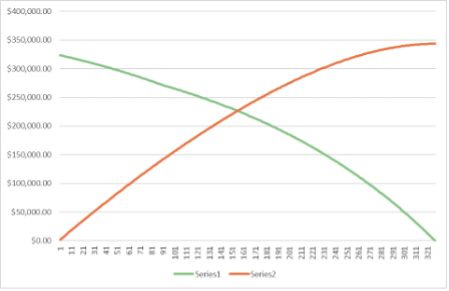

Balance and interest over time for a 30-year mortgage with 10% down payment and PMI

Private mortgage insurance rate is assumed to be 0.55%.

So, the PMI = $324,000*.55% = $1782 per year. This is $148.50 per month. You will have to pay the PMI until you have 20% equity in the property. This translates to 91 payments or a total of $13,513.50.

If instead of paying the PMI, you make equivalent additional payments towards the principle, then you will pay off the loan in 328 months (32 months earlier!) and would pay only $343,487.01 in total interest (A saving of $6,888.58 in interest)

If you continue paying the amount till end of the loan, then you can pay off the loan in 298 months (almost 25 years) and you will pay a total interest of $314,638.57 (A saving of 35,726.39)

Understanding the world of Private Mortgage Insurance empowers homeowners to navigate their financial choices. While PMI safeguards lenders, you’ve got a range of strategies to break free from its hold by making informed financial moves. Remember, personalized advice from financial professionals will guide you toward PMI freedom with confidence.

Here’s some other articles that you may find interesting

Sign up for free personalized refinance tracking