Blog

Learn more

Insights on refinancing, mortgages, and home loans.

Latest stories

Learn about your refinancing options even with less than 20% equity, including FHA Streamline, VA IRRRL, and more.

Explore the differences between reverse mortgages and traditional refinancing to determine which option is best for your financial needs.

Learn how to unlock savings by understanding mortgage refinance quotes, comparing offers, and securing the best deal for your financial future.

Discover the costs involved in refinancing a reverse mortgage, including fees, insurance premiums, and potential benefits.

An informative guide on identifying the ideal time to refinance your mortgage, considering factors such as interest rates, personal financial situation, and market conditions.

Explore how your credit score affects refinancing rates and learn tips to improve your score for better mortgage terms.

Learn how refinancing for home improvement can provide funds, lower interest rates, and increase your home's value. Explore benefits, considerations, and steps here.

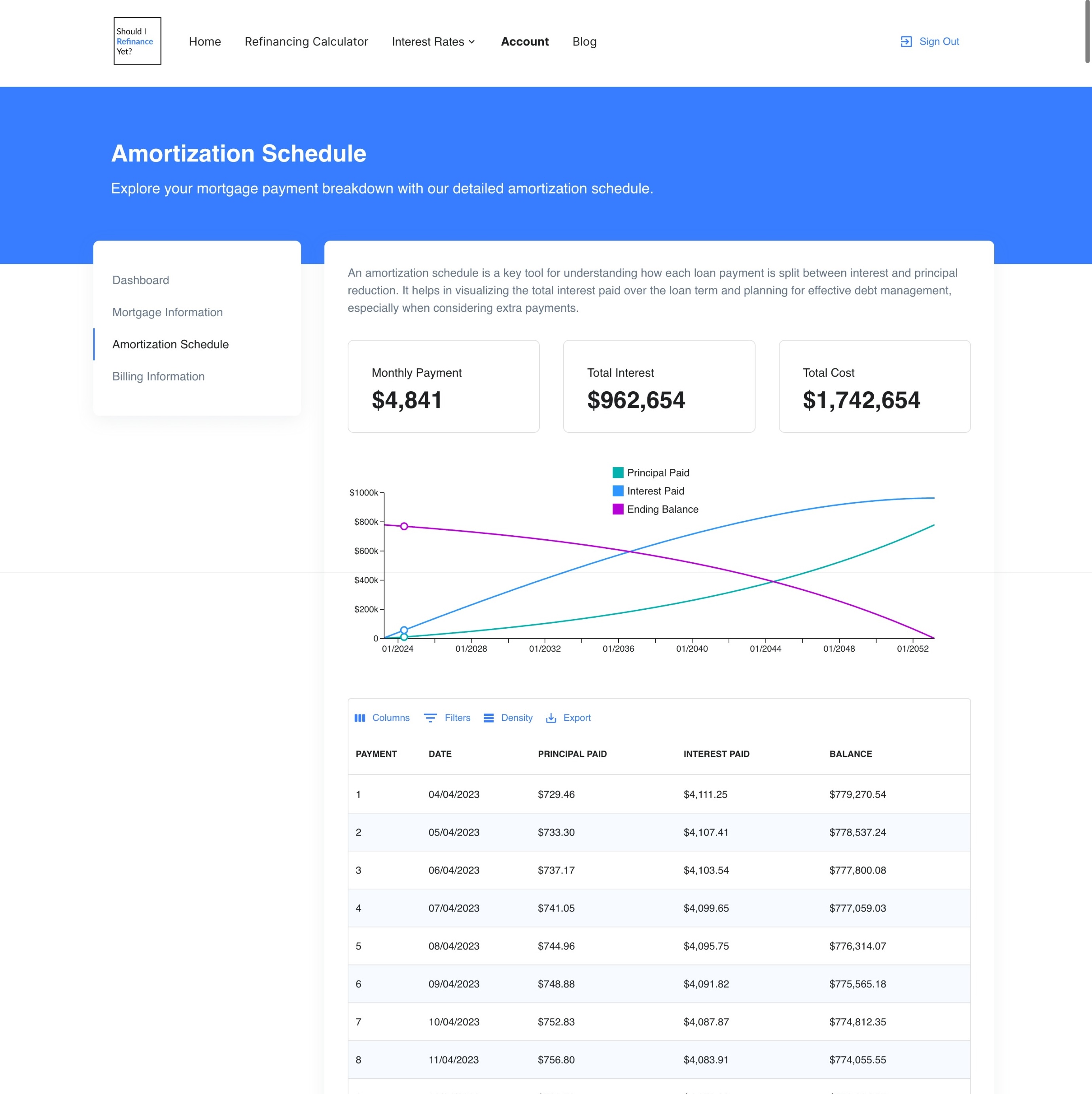

Learn how amortization schedules work and why they matter. Discover tips for managing loans effectively, saving on interest, and planning your financial future.

Learn the benefits and process of converting an adjustable-rate mortgage (ARM) to a fixed-rate mortgage. Understand key considerations and steps involved.

Explore the key aspects of refinancing jumbo loans in 2024, including market trends, eligibility criteria, and strategic refinancing options.

Learn about the USDA refinance options available in 2024, including streamlined assist, standard streamline, and non-streamline refinance, to enhance your financial flexibility.

Explore the VA refinancing options available in 2024, including the streamlined IRRRL and Cash-Out Refinance, to better manage your mortgage and financial goals.

Unlock the benefits of FHA refinancing in 2024 with our comprehensive guide. Understand eligibility, process, and benefits to make informed decisions.

Explore proven strategies to lower your monthly mortgage payments including refinancing options, additional payments, and loan term adjustments.

Learn how to save money on mortgage interest with our top strategies, including refinancing, additional payments, and loan term adjustments.

Maximize your investment returns and manage costs effectively by mastering the refinancing process for rental properties.

Uncover the truth behind common refinancing myths to make informed decisions about your mortgage options.

Explore the differences between refinancing and taking out a home equity loan to determine which financial strategy best suits your needs.

Uncover the pros and cons of adding a co-borrower when refinancing your mortgage. Learn how it affects loan terms, interest rates, and more.

Maximize your refinancing benefits by boosting your credit score with these essential preparation steps.

Explore 2024’s Top Refinancing Options: Save Money, Go Green, and More

Discover the benefits and stability of switching to a fixed-rate mortgage for predictable financial planning.

Unpack the pros and cons of reverse mortgages and cash-out refinancing to make an informed decision that aligns with your financial goals.

Explore the key differences between cash-out refinancing and home equity loans to decide the best way to leverage your home’s equity.

Master refinancing with our expert strategies and real-life success stories, ensuring you secure the best loan terms.

Uncover the essential costs of mortgage refinancing and learn smart ways to save in this concise guide.

Your guide to refinancing seller financed mortgages: key steps, benefits, and securing the best loan terms.

Empower Your Mortgage Refinance Decision with Lender and Rate Insights

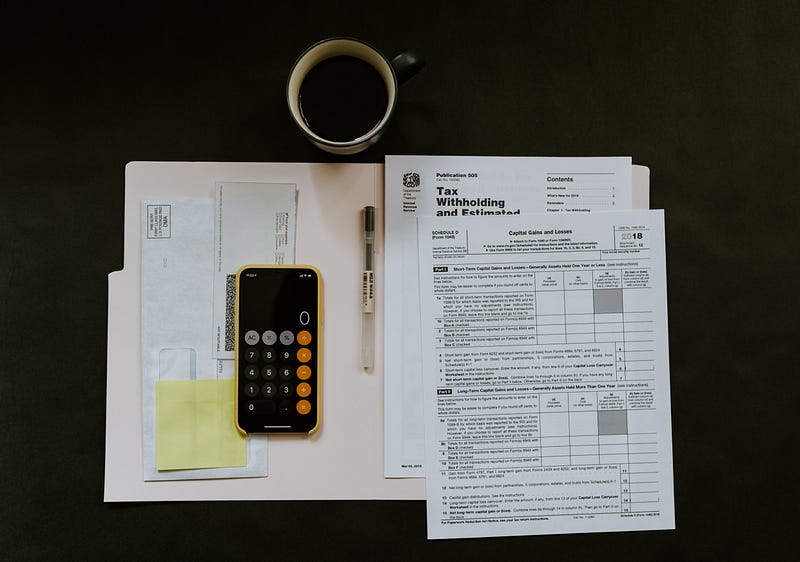

Navigating the Tax Implications of Mortgage Refinancing for a Smoother Financial Journey

Refinancing your mortgage can be a strategic financial move to lower interest rates, reduce monthly payments, or change the terms of your…

Unlocking Your Home’s Potential: The Comprehensive Guide to Cash-Out Refinancing

Unlocking Homeownership: Choosing Between Stability and Flexibility in Mortgages

Unlocking Mortgage Savings: Recasting vs. Refinancing — Making Smarter Financial Choices

Whether you’re in the process of buying a house or have already made the leap, it’s important to understand the ins and outs of Private…

Learn how Federal Reserve policies affect mortgage refinancing rates and what it means for your home loan strategy.

As you consider refinancing your mortgage, one of the key questions you need to answer is: which loan term should you choose?

Your friends are talking about changes in the mortgage world. Interest rate is increasing, again. Possible recession is coming. They saved…

As you start thinking about refinancing, you need to understand the following two concepts in order to make a financially sensible…

Let’s answer some of the common questions you might have about refinancing.