Similar stories

Here’s some other articles that you may find interesting

Save money on your mortgage

Sign up for free personalized refinance tracking

3 Min Read • 03/18/2023

Your friends are talking about changes in the mortgage world. Interest rate is increasing, again. Possible recession is coming. They saved money by refinancing, etc. You are wondering if you should refinance.

I am x years into my 30 years mortgage. Does it make sense to refinance?

Let’s explore the answer to this question through some definitions as well as with illustrative examples.

When you borrow money to buy a house, you need to pay the amount back through periodic (mostly monthly) payments. A part of the periodic payment goes to the principal and another part goes towards the interest on the remaining principal owed to the lender. This process of reducing or paying off your mortgage through regular payments is called amortization of the mortgage. The interest is calculated on the current amount owed and will thus become smaller as you pay down the borrowed principal. This payment schedule is called the amortization schedule.

Let’s look at an example scenario.

Mortgage amount is $300,000, with annual interest rate of 6.0% for 30 years.

This is how the amortization schedule looks like for the loan.

Mortgage Principal: $300,000 Monthly Payment: $1,798.65 Number of payments:360 Total interest paid $347,514.67. Total Loan Cost $647,514.57

The chart above has the breakdown of monthly payment allocation, split between the amount towards interest and the amount towards principal. Key points to consider:

You pay more interest at the beginning of the repayment schedule and it starts to decrease slowly as you pay down the principal. Keep in mind, interest is paid ONLY on the remaining balance and not on the whole mortgage amount.

At month 222 (18.5 years) of the repayment schedule, the interest and principal payments become equal.

This is what is called the front loading of interest.

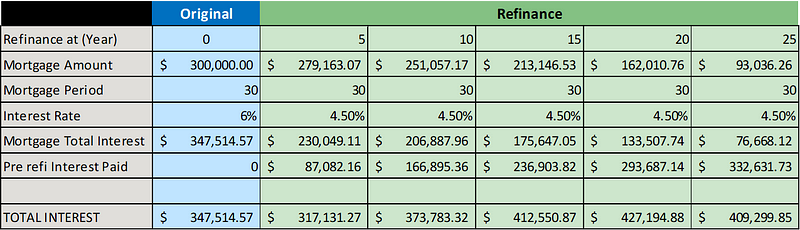

Now, let’s look at what happens when you try to refinance at different times during the repayment schedule, exploring 5-year, 10- year, 15- year, and 20-year options. For simplicity, let’s assume that we are going to refinance the loan for 30 years at an interest rate of 4.5%

As you can see, the later you refinance, the more interest you will have to pay over the period of the loan. This is due to refinance resetting the clock each time and requiring the front-loaded interest payment again.

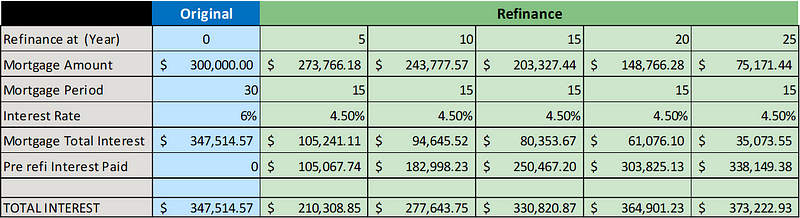

Let’s also examine what would happen if we reduced the refi period down to 15 years from 30 years.

You can see that while the total interest paid is lower after 10 years, it does not make sense to refinance considering other factors above.

Please note that these are illustrative examples to explain the concept of mortgage age. Interest rate, refinancing period, and other factors will impact each case differently. We recommend that you do your own calculations or consult with a financial advisor about how it applies to your specific condition.

It is important to have a valid reason when considering to refinance, not just because someone is telling you so. As illustrated above, there are tangible ways to calculate whether it makes sense for your current situation, generally knowing that the longer you live in the house, the less attractive refinancing numbers will be. We encourage you to calculate the breakeven point (if there is one) and further assess how refinancing could help you achieve your specific goals.

Here’s some other articles that you may find interesting

Sign up for free personalized refinance tracking